The article was published in World Energy Weekly (April 10 issue), a publication of Petrostrategies, a French think tank specializing in energy issues.

Turkey’s next President (whose name will probably be known after the second round of elections on May 28, 2023) will have plenty of options available when it comes to gas strategy. First of all, substantial quantities of gas have been discovered in the Black Sea; secondly, Turkish gas demand is virtually static and is expected to decline, and the country’s position at the crossroads of several major import-export gas pipelines (and its five LNG import terminals) allow it to consider all possible options, such as: cutting the volume of gas imports by choosing suppliers according to both economic AND political parameters; continuing to import the cheapest gas while exporting Turkish gas at the highest possible price (and profiting from the difference); prioritizing security of supply and the diversification of gas sources. Further options may even emerge if more gas resources are discovered in the Black Sea and/or if more gas transits through Turkey.

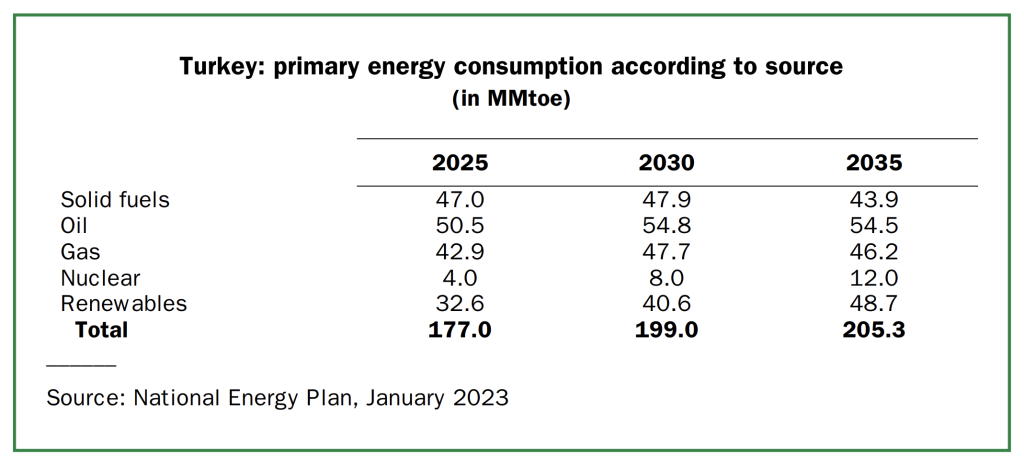

According to the main conclusions of Ankara’s National Energy Plan, published in January 2023, Turkey’s gas consumption is expected to rise at a moderate rate until 2030 before starting to decline under pressure from renewables and nuclear energy. The country’s gas consumption jumped to 56.7 bcm in 2021 before falling to 53 bcm in 2022. The Plan expects Turkish demand to reach 52 bcm by 2025, and then increase to 57 bcm in 2030 before declining to 55.5 bcm by 2035. Turkey is targeting net-zero emissions in 2053. Gas currently accounts for 33% of its power generation, and coal 31%. However, the combined share of these two energy sources, according to the Plan, should be limited to 34% in 2035. The share of nuclear energy (which is currently zero) should have risen to 11% by then, and renewables (including hydropower) should provide all the rest (65% ). In late April, Turkey’s first nuclear power plant, the Russian-built Akkuyu, is due to be inaugurated (with Vladimir Putin in attendance). It will have four 1,200-MW reactors.

The Sakarya gas field in the Black Sea will also start production in late April (on the twenty-first, to be precise, the day scheduled for the end of the Ramadan fast). Discovered in late 2020 at a water depth of 2,100 meters (and 4,775 meters beneath the sea floor), near the point where the maritime borders of Turkey, Bulgaria and Romania meet, the field and its satellites hold estimated reserves of 710 bcm. Initially, gas will be extracted at a rate of 10 MMcm/d (some 3.6 bcm/annum) before reaching a plateau of 40 MMcm/d (about 14.6 bcm/annum) in 2027 or 2028. Research is continuing, however, and it is by no means impossible that further discoveries will be made in the Black Sea.

According to calculations by the Oxford Institute for Energy Studies, issued in April 2022, Turkey has effective gas and LNG purchase contracts (both short- and long-term) for more than 62 bcm/annum. While the state-owned company Botas accounts for 75% of imports, the rest can be attributed to seven “private” companies, including a Gazprom subsidiary. Several import contracts are set to expire by the end of 2025. The first, with Algeria’s Sonatrach, involves the purchase by Botas of 5.5 bcm/annum of LNG: it will expire on December 1, 2024. Under two further contracts, which are set to expire on December 31, 2025, Botas is purchasing 5.75 bcm/annum of gas from Gazprom via the TurkStream gas pipeline. Turkey’s largest gas import contract, which involves the purchase by Botas of 16 bcm/annum from Gazprom via the BlueStream gas pipeline, also expires at the end of 2025. While the gas price in Botas’ contracts with Sonatrach and BlueStream is 100% indexed to oil, it is indexed 30% to oil and 70% to gas hubs (probably the TTF) under the two TurkStream contracts.

In the short term, the fate of these contracts will probably have to be watched to find out what gas choices the Turks will make when they start to produce their own gas, and when alternatives to gas and coal (renewables and nuclear energy) become more widely used for power generation. Together, these rapidly expiring contracts involve imports amounting to 27.15 bcm/annum. Turkey’s other gas import contracts (with more distant expiration dates) can be divided into three groups. The first includes two contracts to buy gas from Azerbaijan (BTE and TANAP). This is the cheapest gas purchased by Turkey, and is supplied by the country that is closest to it politically, at present. “One nation, two states” is a popular slogan in Baku and Ankara. Azerbaijan is heavily indebted to Ankara for its military victory over Armenia in late 2020, and Turkey is its sole transit route to Europe, the only export market for its gas. Ankara can therefore get almost anything it wants from Azerbaijan, including the resale of some of its gas to Europe, especially if (as is believed) Baku is struggling to increase its gas production capacity, as the European Union has requested.

The second group of contracts binds Botas to Iran and Russia. The Iranian contract is entirely oil-based and involves a substantial volume: 9.6 bcm/annum. However, this contractual plateau is rarely reached, and disputes between Ankara and Tehran (over the price of gas, its “quality”, and so on) are quite frequent. The contract expires at the end of July 2026 and political and commercial negotiations to extend it or not (and in what form) promise to be intense! In addition to the contracts that expire in 2025 (see above), Botas has three minor contracts with Russia totaling 5 bcm/annum. They are indexed 30% to oil and 70% to gas hubs and will expire in 2043. Unless a major hiccup occurs in Russian-Turkish political relations, these contracts are expected to run their course. The third group of import contracts, which relate to LNG, is the most diverse, and involves short-term, medium-term and long-term agreements. LNG is imported via three underutilized FSRUs, with a combined capacity of 15.15 MMt/annum (in addition to the LNG imported via Botas’ two onshore terminals, Marmara Ereglisi and Izmir Aliaga, already mentioned).

Whichever choices Turkey makes in its gas and LNG import contracts, there is one avenue that it will never abandon: the development of its role as a transit route for gas on its way to Europe, which allows it to receive royalties, to strengthen its security of supply and to have significant political leverage in negotiations with the European Union. Its most advanced project involves doubling the capacity of the TANAP gas pipeline, which currently serves to transport some 11 bcm/annum of Azeri gas to southern Europe. As far as Iran is concerned, Ankara doesn’t have too much to worry about: if the European Union decides one (hypothetical) day to import Iranian gas, it will only be able to do so via Turkey (unless the Iranians finally manage to develop their LNG export sector). That leaves gas from Russia and the Eastern Mediterranean. The former has become highly dependent on Turkey for its exports of gas (and large amounts of oil) since its invasion of Ukraine and the sanctions against its hydrocarbon sector. Vladimir Putin has offered Turkey the role of a hub for Russian gas, but negotiations between the two parties are progressing rather slowly (and it shouldn’t be forgotten that Europe will have a say when the time comes). Further south, the proposed EastMed gas pipeline, which would run from Israel to Greece via Cyprus, has been given a new impetus over the last few weeks. However, Turkey can seriously challenge this project, both politically and legally, by arguing that the pipeline will have to pass through its territorial waters, which it expanded to touch those of Libya in November 2019. In short, few countries in the world have such rich and varied options in the gas sector!

Read the article in Armenian: Թուրքիան ամրապնդում է իր դերը գազի միջազգային շուկայում. Petrostrategies