For the past months the Armenian public (for the matter of fact not only the Armenian public, but also the international community as well) is witnessing some negative developments around two of its private sector giants.

The trouble began with Lydian, arguably the biggest international investor in Armenia. Last month Lydian International publicly announced that, in connection with the ongoing road protests resulting in the blockage of access to the Amulsar Gold project, Lydian UK and Lydian Canada, subsidiaries of Lydian Int., have formally notified the Armenian Government of the existence of disputes with the latter under the Bilateral Investment Treaties of Armenia with UK and Canada. In the announcement, Lydian has mentioned that the initiation of arbitral proceedings against Armenia will depend on further conduct from the side of the Government. Interestingly, so far there is no word from the Armenian authorities (at least publicly). The clock is ticking though, and the three-month deadline is closing in. Silence.

The second hit was targeted to the Armenian corporate giant Spayka, who took the blow of the forceful fist of the Armenian authorities few weeks ago. This time the allegations are built upon (at least publicly) the assumptions that Spayka and/or its shareholders/directors have allegedly evaded taxes, which resulted in criminal investigation. Spayka’s CEO and shareholder Davit Ghazaryan got detained and charged.

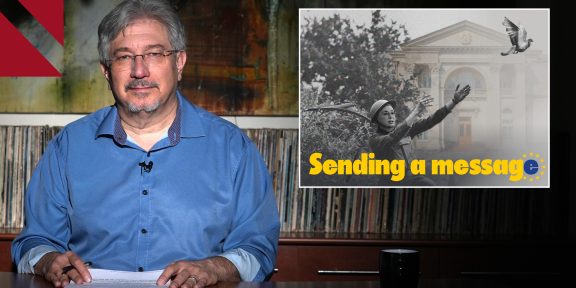

Not wanting to be the “messenger of bad news” or bayghoush as the popular folklore calls it down here in Armenia, but I cannot stop thinking “Who’s next?”. I do not want to focus on the “Who’s next?” question though. Rather, I would like to rhetorically ask the “What’s next?” question. How are these developments affecting Armenia’s investment climate and international reputation among investors and donors? Donors. Let’s just stop for a moment on that word.

Since its independence Armenia’s biggest investors have been its donors. First, with budgetary contributions, later in the infrastructure and for the past decade or so in the private sector. I don’t know of any significant international investor who has made an investment in Armenia without some serious handholding from the donor community or the Armenian government. Like it or not, the Armenian investment climate has not been attractive for an independent investor for a myriad of reasons: lack of access to international markets, conflict with its neighbors, unsophisticated legislation, corrupt judicial and regulatory environment, shallow capital markets (continue if you wish). These factors haven’t changed so far, though they played an important role for the international donor community (such as EBRD, ADB, IFC, French Development Agency, etc. ) to take an active role and somewhat shift from making primarily public sector investments to private sector ones as well. The presence of the International Financial Institutions (IFI) and other donors naturally was inter alia aimed at boosting confidence for other investors, providing technical support and increasing sophistication among those Armenian companies who were at the receiving end of those investments. Hopefully, at some point these companies would have “graduated” and ready to attract independent/private investors. Will they be able after these developments? Hardly.

I would like to take the liberty and doubt that these punches are affecting our investment climate and economy in general in a positive way. On the contrary. The default setting of a regular investor is to walk when the dirt hits the fan and I am guessing it has done so (would love to see myself being wrong).

So, what’s coming next? I am guessing crisis management lawyers are sharpening their knives to move in. If they do, nothing good should be expected from the economy, because as the famous Billy Ocean’s song puts it: When the going gets tough, the tough get going!